As a result of the financial crisis in 2008, and many financial scandals of the prior decade, the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank Act”) was created to better impose regulations on banking and other financial institutions.[1] While the majority of the Dodd-Frank Act focused on specific regulations related to companies, a section acknowledges that one of the best means of identifying and stopping fraud and abuse comes from internal knowledge. Specifically, the Dodd-Frank Act requires the Securities and Exchange Commission (“Commission”) to pay awards to whistleblowers who provide the Commission with original information about violations of federal securities laws. This provision and the related program have enhanced the Commission’s ability to identify, stop, and prosecute waste, fraud, and abuse. The success of this federal program has led many businesses to adopt similar programs at the company level.

Positive Results of Whistleblower Program

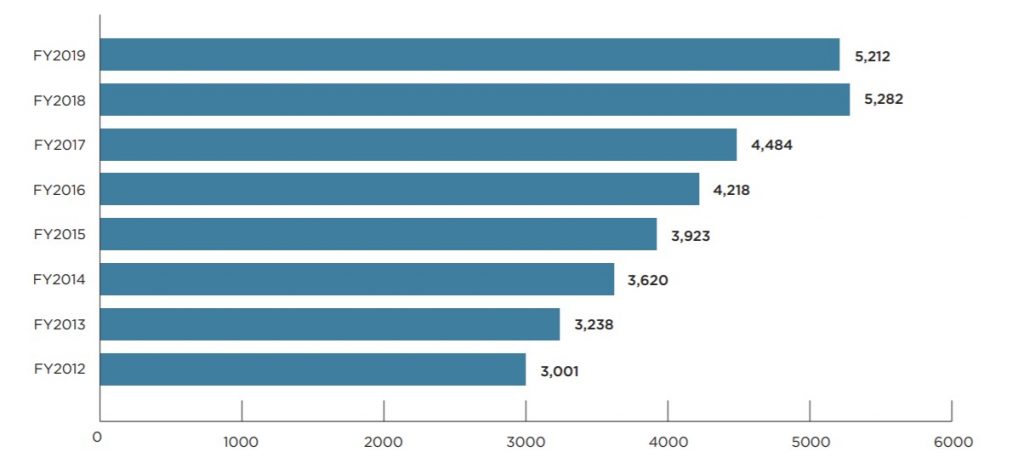

In recent years, a small number of individuals have earned large monetary sums through the federal whistleblower program, with the incentives continuing to rise over time. In the decade since the program began, the Commission has issued nearly $400 million to about 70 individuals, with more than half of this award money going to people in the last two years.[2] In addition, the Commission has received more than 30,000 whistleblower tips since 2011, with the total number of tips nearly doubling in the last several years.[3] Below is a chart depicting data which reveals more individuals are stepping forward each passing year with whistleblower tips.[4]

Common Types of Fraud Identified by Whistleblowers

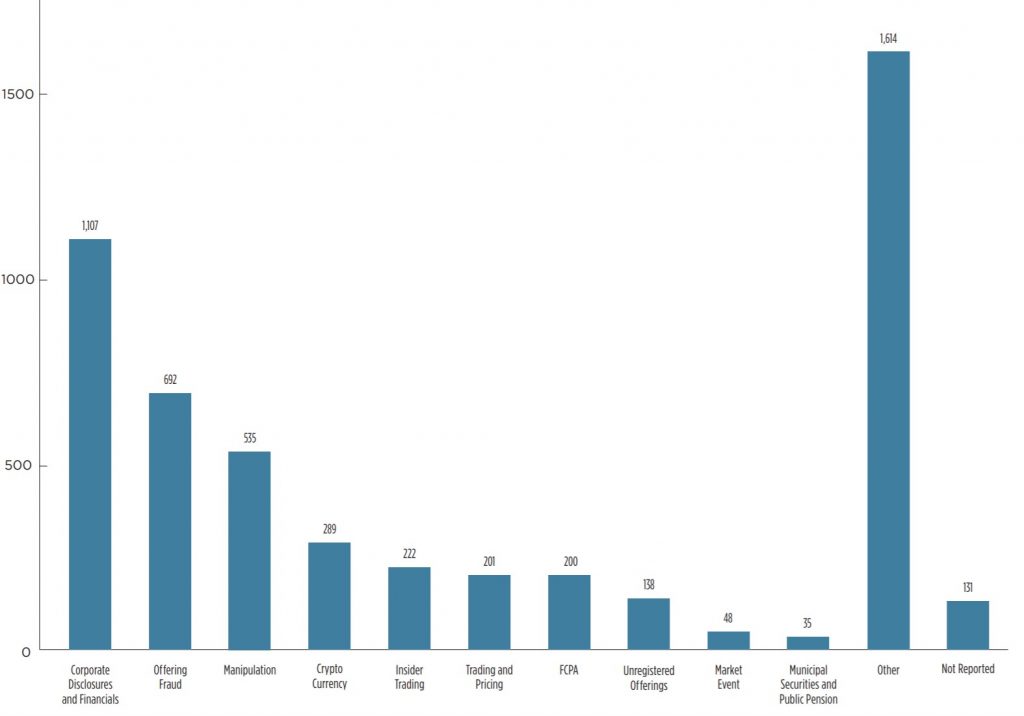

Many types of fraud can be committed by companies or organizations. The Commission keeps track of the types of allegations whistleblowers bring forward. In 2019, many of the tips received by the Commission fell into the following four areas: corporate disclosure and financial statements, investment fraud, manipulation, and crypto-currency.[5] From the graph below, the statistics indicate that the Commission received a substantial amount of tips over just this past year alone, and they include a variety of categories. Although all allegations are serious, it is important for the Commission to categorize the most common types of allegations that whistleblowers provide so that more effort is utilized to proactively combat those specific types of fraudulent actions in the future.[6]

Application of Whistleblower Policies at The Company Level

Companies, and at times individuals, are incentivized to cover up fraudulent behavior. Unfortunately, fraud can occur anytime and anywhere. While companies may worry about the bottom line and want to avoid any possible financial repercussions related to fraud, they must also be mindful of how potentially fraudulent activity affects their reputations. In order to combat this, companies need to develop controls to ensure fraudulent activity is minimized as much as possible. First and foremost, companies should set a strong tone at the top, meaning that management and executives should lead by example with ethical behavior.[7] Companies that are compliant with rules and regulations are less likely to experience fraudulent activity, and companies that perform periodic risk assessments and provide thorough training programs for their employees are better able to reduce the risk of fraud.[8]

However, fraud still occurs. To address this, and knowing that fraud is often identified through tips from employees, companies should institute whistleblower hotlines to encourage employees of all levels within an organization to come forward with information on suspicious behavior or activity. For large corporations, implementing whistleblower hotlines are relatively inexpensive and easy to maintain, with extra care taken to ensure that the structure and functionality of the means to communicate any allegations is strong.[9] Many companies have instituted these hotlines which allow employees to anonymously communicate not just suspicion of fraudulent activity but more general ethical concerns as well. Although hotlines may not be able to always detect fraudulent activity occurring within a company, they can be available to all employees for 24 hours a day, 7 days a week. They can also be comprised of many communication channels and provide for more than one language, the latter of which is a critical tool for larger international corporations.[10] It is important for all employees of a company to feel comfortable coming forward with information that may be useful in combating fraudulent behavior. In the long run, negative actions taken by anyone in a company will be damaging to all within an organization, even those not directly involved in the fraud.

Conclusion

Fraud and other illegal acts impact all of us, and unfortunately, they will continue as long as anyone perceives a way to carry out nefarious actions for personal or corporate gain. Setting the right tone from the top and establishing a company-specific whistleblower hotline can act as deterrents to such activity. These efforts should be reinforced with proper and consistent communication of the risks of fraud as well as the methods that individuals can utilize to come forward and be the first line of defense in identifying it. Through the Commission’s own whistleblower program, it is able to cast a wide net to identify the individuals and companies that are not working towards the best interests of employees and the public at-large.

Chess Consulting Background

Chess Consulting assists companies and their legal counsel with internal and government-initiated investigations, as well as forensic accounting-based investigations. Our technical accounting and audit experts bring significant forensic accounting, damage analysis, and litigation support experience to find the root cause of issues and bring clarity to complex matters.

Our investigation and forensic accounting areas of expertise include, but are not limited to:

- Circumvention of Internal Controls

- Complex Accounting and SEC Regulations

- False Claims Act (FCA)

- Foreign Corrupt Practices Act (FCPA)

- Forensic Accounting

- Accounting Errors and Irregularities

- Voluntary Disclosures

- White Collar Crime

For any inquiries, please reach out to Ed Tharp.

[1] https://www.sec.gov/files/sec-2019-annual%20report-whistleblower%20program.pdf (pg. 4)

[2] https://kmblegal.com/sec-whistleblower-blog/sec-whistleblower-program-2019-annual-report-highlights-continued-success

[3] https://kmblegal.com/sec-whistleblower-blog/sec-whistleblower-program-2019-annual-report-highlights-continued-success

[4] https://www.sec.gov/files/sec-2019-annual%20report-whistleblower%20program.pdf (pg. 22)

[5] https://www.sec.gov/files/sec-2019-annual%20report-whistleblower%20program.pdf (pg. 23)

[6] https://www.sec.gov/files/sec-2019-annual%20report-whistleblower%20program.pdf (pg. 23)

[7] https://mazarsusa.com/ledger/whistleblowers-a-path-to-combatting-fraud/

[8] https://mazarsusa.com/ledger/whistleblowers-a-path-to-combatting-fraud/

[9] https://internalaudit360.com/internal-audits-role-in-assuring-whistleblower-hotlines-are-effective/

[10] https://internalaudit360.com/internal-audits-role-in-assuring-whistleblower-hotlines-are-effective/